Frequently Asked Questions

1. Why does West Point need private support?

Contrary to popular belief, the United States Military Academy is not funded solely by federal tax dollars. While federal funding provides the basic requirements for cadets to earn Bachelor of Science degrees and commissions in the U.S. Army (the academic program, room, board, military training, and basic facilities), private-sector gifts to the Academy’s Margin of Excellence provide the additional support needed for cadets to reach their highest potential (out-of-classroom leadership options, cultural immersion opportunities, club and athletic team experiences, improved facilities, academic research centers, etc.). Because graduates will likely face situations of national importance during their careers, the Margin of Excellence at West Point is so much more than just “the icing on the cake”; it is essential for our graduates to succeed as defenders and leaders of our nation. WPAOG functions as the Academy’s fundraising arm because military personnel and representatives of the federal government are prohibited by law from soliciting funds, goods, or services.

2. How do federal tax dollars and donor gift funds interrelate?

The WPAOG Memorandum of Understanding with USMA states that WPAOG will raise money for USMA needs “for which appropriated money is not available and is unlikely to become available.” The Academy’s private funding needs continue to grow substantially due to rising educational costs and decreasing federal funding.

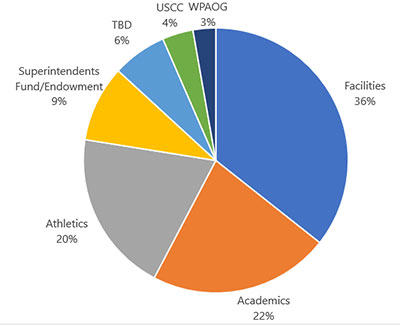

3. How much is raised in a fiscal year, and for what purposes?

The majority of gifts received, invested, and stewarded by WPAOG are for USMA. For example, in 2021 WPAOG received $55.3 million in cash receipts. Of this total, approximately $53.8 million or 97% was earmarked by donors for West Point’s Margin of Excellence, while $1.5 million or 3% was designated to support WPAOG’s alumni support programs.

4. Is my gift tax-deductible?

West Point Association of Graduates (WPAOG) is a tax-exempt organization incorporated under the State of New York laws. WPAOG is officially listed in the IRS Cumulative list of Exempt Organizations (IRS Publication 78) as an organization qualified for maximum deductibility. Gifts to WPAOG receive all of the income tax and estate tax benefits allowable under the law. The official title of WPAOG in the IRS Publication is “Association of Graduates of the United States Military Academy, West Point, New York.” Its Federal Identification Number is 14-1260763.

5. What is the Superintendent’s Annual Fund?

Donations to the Superintendent’s Annual Fund are unrestricted gifts for West Point. The Superintendent’s Annual Fund is important because these gifts are used by the Academy to “fill in the gaps” and fund urgent, current needs.

6. What is the Long Gray Line Fund?

Gifts to the Long Gray Line Fund provide valuable operational support for the WPAOG by funding existing programs for alumni, widows, parents, and friends of West Point. These donations enable WPAOG to provide services to graduates worldwide with the goal of becoming the most highly connected alumni body in the world.

7. What are the Superintendent’s Circle and the Chairman’s Circle?

The Superintendent’s Circle is a recognition program that acknowledges graduates, parents, and friends who believe in and make yearly gifts of $1,000 or more to the Superintendent’s Annual Fund, or West Point Parents Fund within the calendar year (Jan 1 – Dec 31).

The Chairman’s Circle is a recognition program that acknowledges graduates, parents, and friends who believe in and make yearly gifts of $1,000 or more to the Long Gray Line Fund or Long Gray Line Endowment within the calendar year (Jan 1 – Dec 31).

8. What is the ‘A’ Club?

Gifts to the Army “A” Club support West Point’s intercollegiate athletic teams. The financial support from generous donors contributes to the program’s long term growth and prosperity. It also supports the Academy’s overall mission of producing leaders of character by providing an extraordinary Division-1 athletic experience for our over 1,000 cadet-athletes.

9. What is the Class Gift Fund?

The Class Gift Fund is a tangible account where funds designated to a particular class reside until the class presents a gift to a chosen Academy need. Gifts made to the Class Gift Fund are not disbursed to the Academy for immediate use but remain in the fund until the class directs a transfer to the Academy at their reunion.

10. What’s the difference between a fund and an endowment?

A fund provides the means for donors to make gifts to West Point and for those dollars to have an immediate impact on the institution’s greatest needs. An endowment comprises donations to an institution with the stipulation that the gift be invested and the principal remains intact. A portion of the interest is spent every year, and the rest is reinvested to compensate for inflation and recessions in future years. Gifts to an endowment continue to grow over time and provide a constant, reliable source of income. A combination of current-use dollars (annual fund) and long-term investment (endowment) allows West Point to manage short- and long-term needs effectively.

11. What gifts count towards the Lifetime Giving Societies?

The total of all gifts received during a donor’s lifetime determines membership in the new giving societies. Corporate matching gifts count toward society membership. Total lifetime giving will be recognized by society membership as described here.

12. I heard that a surcharge is applied to gifts made to West Point through the West Point Association of Graduates. Why?

The WPAOG Development Office functions as the Academy’s fundraising arm because military personnel and representatives of the federal government are prohibited by law from soliciting funds, goods, or services. Because federal government agents are forbidden from soliciting gifts, USMA has elected to reinvest a portion of all WPAOG Development gifts. The exact fees assessed on gifts made through WPAOG are determined by a Memorandum of Agreement (MOA) between the Superintendent of the Academy and the Association Chairman. This MOA is reviewed annually. It is important to understand that 100% of your gifts directly benefit West Point. To operate even more efficiently and get more donor dollars to the activity that a donor wishes to support, a new memorandum of agreement has been signed by West Point and WPAOG that lowers the gift allocation percentage on each gift from 12% to 10% effective January 1, 2021. The average non-profit takes between 15% to 24% of each gift for operations.

The Development Office at West Point Association of Graduates differs from those of other higher educational institutions. Many other colleges and universities’ foundations fall under the institution itself and are funded by the institutional budget. In these cases, the fees do indeed exist, often at much higher percentages than at West Point. However, they are not always transparent.

The gift assessment is not a payment from individuals, classes, corporations, or foundations to WPAOG Development in exchange for services, but an investment mandated by USMA to ensure future fundraising success for the Academy. The gift assessment does not constitute a quid pro quo agreement between an individual, class, corporation, or foundation and WPAOG. All non-for-profit organizations must bear the costs of raising funds.

13. What are the primary sources of private funds?

As the industry standard for colleges and universities, alumni are the largest source of funding.

24,372 Total Donors in 2021

- 79% from Alumni (19,143) – Representing 37.1% of our 51,562 Solicitable Alumni in 2021

- 21% Non-Alumni (5,229)

- 9% Parents

- 9% Friends

- 2% Corporate & Foundations Relations

- 1% Surviving Spouses

14. When does my gift reach the USMA or WPAOG designation?

As per our agreement with USMA, the WPAOG proffers all gifts of the previous year, the “Annual Distribution,” each May or June. Any gift that is needed before the next Annual Distribution will be proffered “out of cycle”.

If you have additional questions regarding giving to West Point please contact the Office of Annual Giving at annualgiving@wpaog.org or 845.446.1657